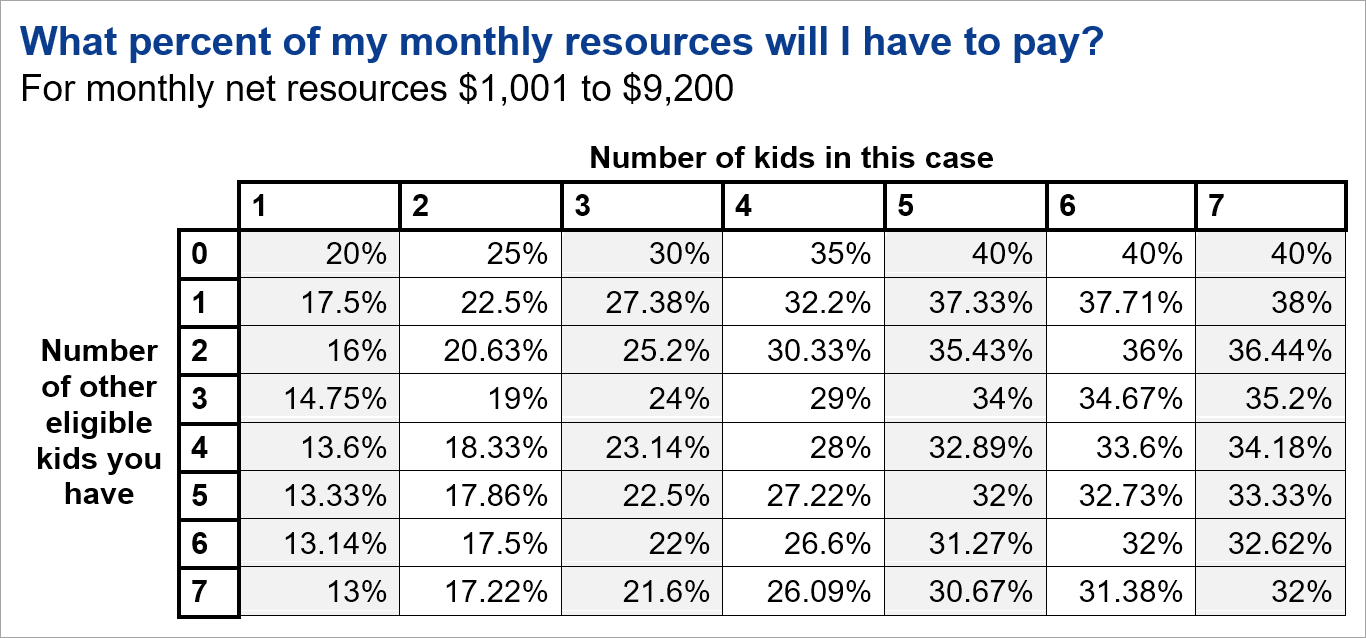

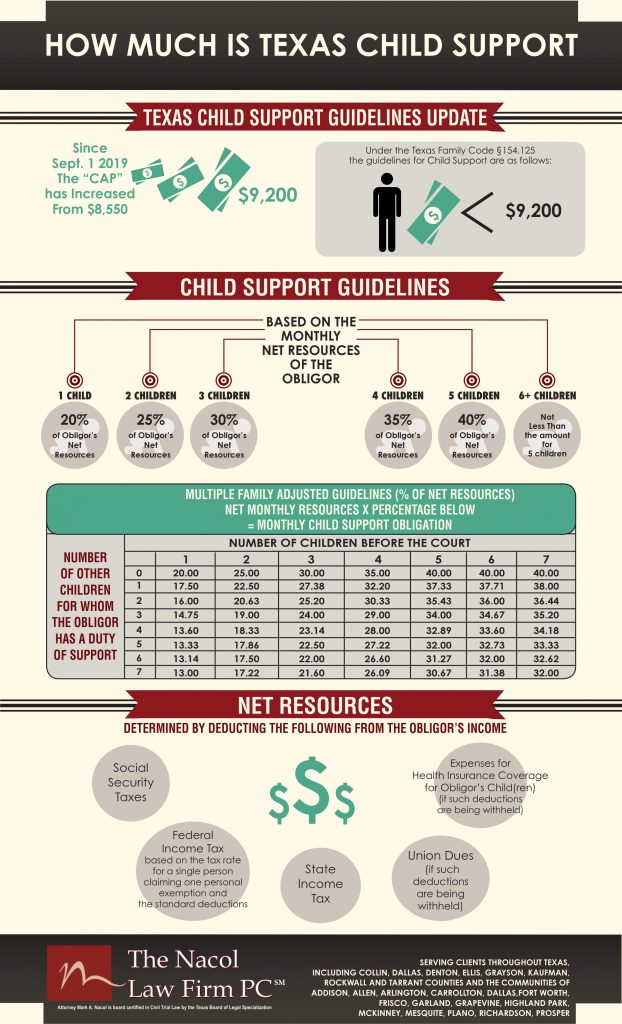

The guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than 9 200.

Texas attorney general child support calculator 2020.

These tax charts are applicable to employed and self employed.

Page 1 of 4 form 3n051 income withholding for support iwo june 2018 omb 0970 0154 expiration date.

Please log on to your child support account to chat with a live agent now.

The texas attorney general child support division is experiencing higher than normal call volume.

Texas family code section 154 001 et seq.

During this time while physical child support offices will be closed to customers and visitors services will continue to be provided over the telephone and internet.

When you have completed the form click on the calculate button to get an estimate of the amount of child support that the non custodial parent will have to pay to the custodial parent in texas.

See the 2020 texas attorney general s tax charts.

This calculator does not calculate support in excess of the 9 200 net resource amount per texas family code sec.

For child support purposes net resources total earnings minus social security taxes income taxes for a single person and dependent health insurance.

Pursuant to 154 061 b of the texas family code the office of the attorney general of texas as the title iv d agency has promulgated the following tax charts to assist courts in establishing the amount of a child support order.

Online applications find child support locations map touchpay payment kiosk locations map access visitation locations map access visitation locations search p a p a.

08 31 2020 income withholding for support.

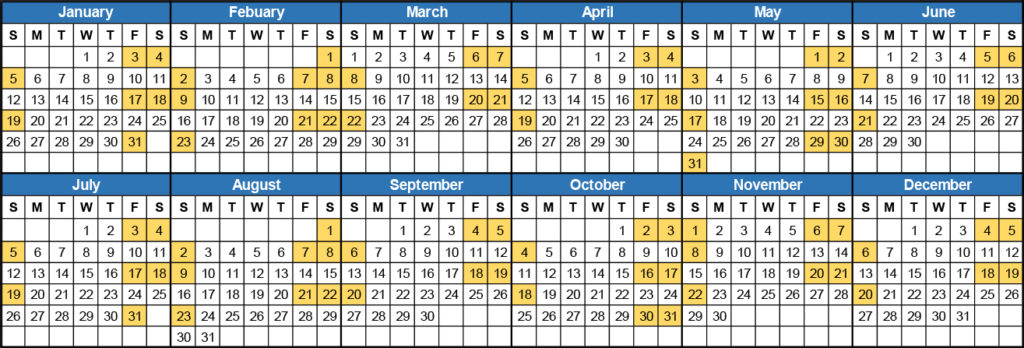

Training calendar child support evaders list child support calculator.

Office of the attorney general.

To use the child support calculator select or enter the appropriate information next to each statement.

Calculator not for use if monthly net resources exceed 8 550 per family code 154 125 a.

These guidelines apply to.

Not less than the amount for 5 children note.

Texas attorney general s tax tables from 2018 or before will be inaccurate for calculating child support under the 2019 revised maximum child support cap increases and social security and tax rate increases decreases under the 2017 and 2020 tax law changes.

The texas attorney general s child support division is in the process of transitioning to providing virtual child support services.

Child support amounts are based on a percentage of the monthly net resources of the obligor and the number of children.

Online forms volunteer with child support access visitation provider update request p a p a.

.png)